A closely watched battle between businesses and insurers over alleged violations of Illinois’ landmark biometric privacy law is heating up, with state and federal appeals courts staking out conflicting positions over who pays for the legal defense costs.

The issue will be at the forefront on Wednesday when the US Court of Appeals for the Seventh Circuit hears Illinois car accessory company Thermoflex Corp.’s biometric insurance dispute against an

In a separate case, the Illinois court last month ruled in favor of a

The Illinois appeals court’s December decision was a warning to companies facing increasing class actions and jury demands alleging they took sensitive information from employees or consumers without consent. Meanwhile, insurers can lean on the ruling to deny coverage for alleged privacy lapses, leaving more businesses sandwiched between underlying class actions and insurers’ lawsuits seeking to avoid payment, attorneys say.

“The lack of insurance coverage in certain circumstances can be catastrophic,” said Gerald L. Maatman, chair of Duane Morris LLP’s workplace class action group. BIPA class actions are expensive and “can spell bankruptcy,” he said.

Maatman said he’s seen a spike in BIPA class actions against companies—not just in Illinois, but also in California, Delaware, Michigan, and other states—after the Illinois Supreme Court expanded the potential for high damage awards in a decision last February. BIPA applies to companies doing business in Illinois, as well as those with employees or customers from the state.

The Illinois state appeals court ruling set a strong precedent for courts across the nation analyzing biometric insurance issues, as insurance disputes are governed by state laws, and the panel was reviewing an Illinois-specific statute. It will likely be taken up by the Illinois high court, industry attorneys say, with the policyholder—Visual Pak Co.—expected to appeal.

“There’s a good chance the Illinois Supreme Court takes it,” said Amy Frantz, a partner at Freeman Mathis & Gary who represents insurers.

‘Catch-All’ Exclusion

The insurance disputes hinge on a sweeping and frequently used “violation of statutes” policy clause excluding payments for claims alleging companies ran afoul of privacy-related laws.

ThermoFlex on Wednesday will argue that a lower federal court wrongly held the policy exclusion bars coverage for a BIPA claim. The Seventh Circuit ruled in a separate case last year that the exclusion doesn’t apply, but the Illinois state appeals court said the federal panel made a mistake.

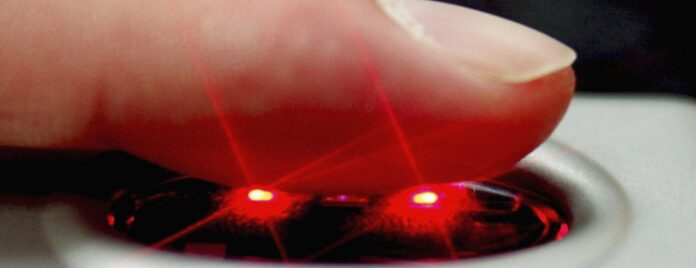

In the case reviewed by the state appeals court, a temporary employee assigned to the policyholder Visual Pak alleged he was required to scan his fingerprints when reporting for work, without his approval. The company settled the complaint for $19.5 million, paying $3.5 million and turning to insurance to cover the rest.

The insurers turned around and sued to avoid coverage, citing the catch-all policy exclusion.

Siding with the carriers, the Illinois state appeals court rebuked the policyholder-friendly decision in June from the Seventh Circuit holding that the same catch-all clause makes the insurance contract ambiguous. The state court said the federal appeals court was wrong when it held the clause is overly broad and nullifies coverage under BIPA.

The Seventh Circuit’s June ruling raised alarms for insurers throughout the industry with similar language. “The breadth of an exclusion in and of itself does not make an exclusion ambiguous,” said Frantz.

Vague Language

Policyholder attorneys say the Illinois appeals court made a mistake.

“Insurance exclusions are supposed to be read narrowly as a matter of insurance policy construction, and instead the Illinois appeals court stretched it in order to include BIPA, even though BIPA is not listed in it,” said Daniel Healy, a partner at Brown Rudnick LLP who represents corporate policyholders.

The fact that multiple courts have reached different conclusions on the same policy exclusion shows the insurance terms are ambiguous and should be read in favor of coverage, said Scott N. Godes, co-chair of Barnes & Thornburg LLP’s insurance recovery practice.

Insurance contract laws put the onus on insurers to write clearer language because small businesses don’t have the ability to negotiate contracts when buying liability coverage, said Peter Halprin, a partner at Haynes and Boone LLP who represents policyholders.

“A lot of them are faced with policies that are 200 to 300 pages long. And the idea that they would go line by line through it to try to make changes with the insurers is folly,” he said.

Both policyholders and insurers now expect the Illinois high court to weigh in.

“The state Supreme Court has taken every issue it’s been asked to consider related to BIPA,” Frantz said.

The Illinois appeals court case is National Fire Insurance Co. of Hartford v. Visual Pak Co. Inc., Ill. App. Ct., 1st Dist., No. 1-22-1160.

The Seventh Circuit case is Thermoflex Waukegan, LLC v. Mitsui Sumitomo Insurance USA, Inc., 7th Cir..